If you’re eyeing a career in the insurance industry, understanding the insurance adjuster salary is a smart starting point. Many people enter this field seeking stable income with growth potential, but salaries can vary widely based on experience, location, and job type. In this comprehensive guide, we’ll break down average earnings, influencing factors, and real-world insights to help you decide if this path fits your goals.

We’ll explore everything from entry-level pay to advanced roles, including a comparison table of salaries by state and a pros/cons list for the profession. By the end, you’ll have a clear picture of what to expect in 2025.

What Does an Insurance Adjuster Do?

Insurance adjusters play a crucial role in the claims process. They investigate insurance claims, assess damages, and determine how much the insurance company should pay out. This involves inspecting properties, interviewing witnesses, and reviewing policy details.

The job demands strong analytical skills and attention to detail. Adjusters often work under tight deadlines, especially after major events like storms or accidents.

Types of Insurance Adjusters

There are several types of adjusters, each with unique responsibilities and salary ranges.

- Staff Adjusters: Employed directly by insurance companies. They handle everyday claims like auto accidents or home damage.

- Independent Adjusters: Contractors hired by insurers during high-demand periods, such as natural disasters. They often travel and work on a per-claim basis.

- Public Adjusters: Represent policyholders, not insurers. They negotiate settlements to maximize payouts for clients, earning commissions.

These distinctions affect earning potential, with independents sometimes outpacing staff roles in busy seasons.

Average Insurance Adjuster Salary in 2025

Based on recent data from sources like the U.S. Bureau of Labor Statistics (BLS) and job sites, the national median salary for claims adjusters hovers around $76,000 annually. However, averages can reach $82,500 when factoring in bonuses and overtime.

Entry-level positions typically start lower, while seasoned professionals command higher pay. In 2025, expect slight increases due to inflation and industry demand.

Entry-Level vs. Experienced Salaries

Newcomers to the field often begin with salaries between $50,000 and $65,000. This reflects basic licensing and on-the-job training.

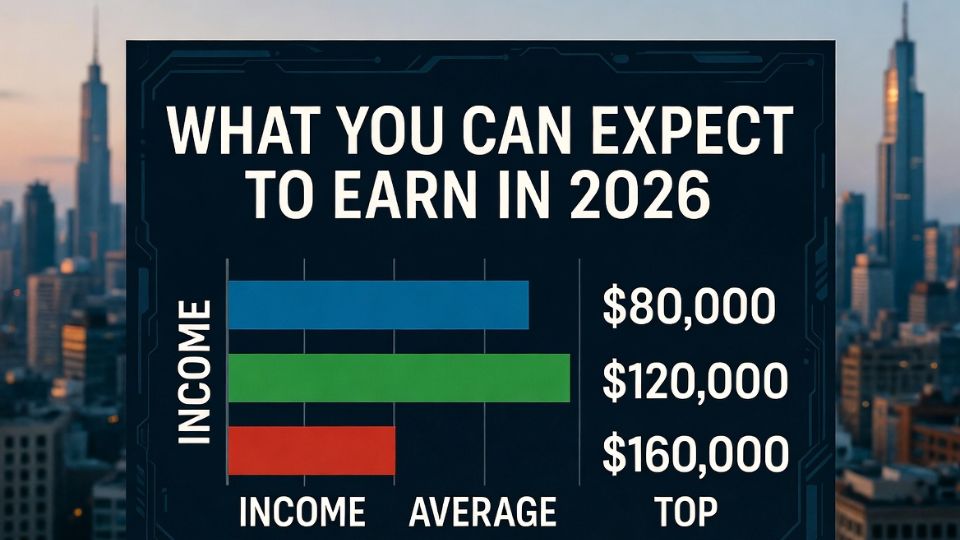

With 5+ years of experience, earnings can climb to $80,000–$100,000. Certifications like the Chartered Property Casualty Underwriter (CPCU) boost this further.

Top earners, especially in specialized areas, exceed $120,000. Catastrophe adjusters during hurricane seasons can see surges from overtime.

Salary Variations by Specialization

Different claim types influence pay. Auto adjusters might earn $50,000–$73,000, focusing on vehicle inspections.

Property adjusters, dealing with homes and buildings, average $55,000–$85,000. Workers’ compensation specialists fall in the $55,000–$83,000 range.

Commercial claims adjusters handle business losses and often see higher figures, around $71,000 on average, due to complexity.

Insurance Adjuster Salary by Location

Location is a major salary driver. Urban areas with high living costs and frequent claims pay more.

Coastal states prone to weather events offer opportunities for independents. Inland regions might have steadier but lower staff positions.

Top-Paying States for Insurance Adjusters

Data from ZipRecruiter and BLS highlights variations. Here’s a comparison table of average annual salaries in select states, based on 2024–2025 figures:

| State | Average Salary | Notes |

|---|---|---|

| Washington | $85,000 | High demand in tech hubs like Seattle. |

| Michigan | $80,000 | Strong auto insurance sector. |

| Georgia | $78,000 | Growing population drives claims. |

| Oklahoma | $77,500 | Energy industry influences commercial claims. |

| Mississippi | $77,000 | Affordable living boosts net take-home. |

| Florida | $76,000 | Frequent hurricanes mean bonus opportunities. |

| Texas | $75,000 | Large state with diverse claim types. |

| California | $82,000 | High cost of living offsets earnings. |

| New York | $81,000 | Urban density increases complex cases. |

| Ohio | $70,000 | Steady but lower than coastal averages. |

These figures are medians; top 10% in high states can exceed $100,000. Always check local job postings for the most current data.

Lower-paying states like Ohio or parts of the Midwest offer around $65,000–$70,000. Relocation for better pay is common in this field.

Factors Influencing Insurance Adjuster Salaries

Several elements shape what you’ll earn. Understanding them helps in career planning.

- Experience and Education: A bachelor’s degree in business or finance isn’t always required, but it helps. Entry requires a state license, obtained via exams.

- Certifications: Advanced creds like Associate in Claims (AIC) add 10–20% to salaries.

- Job Type: Independents earn variably, up to $100,000+ in peak times, but face income instability.

- Employer Size: Large insurers like State Farm offer benefits packages worth $10,000–$20,000 annually.

- Economic Conditions: Post-disaster surges increase demand and pay for field adjusters.

Overtime and bonuses are common. Many adjusters report 10–15% extra income from these.

Pros and Cons of Being an Insurance Adjuster

Like any job, this role has upsides and challenges. Here’s a balanced look.

Pros

- Lucrative Potential: Six-figure earnings possible for independents during busy seasons.

- Job Security: Recession-proof, as claims occur year-round.

- Variety: No two days are the same—mix of office work, fieldwork, and client interactions.

- Helping Others: Assist people in tough times, providing a sense of purpose.

- Flexibility: Remote options for desk roles; travel for those who enjoy it.

Cons

- High Stress: Dealing with emotional claimants and tight deadlines.

- Irregular Hours: On-call during emergencies, disrupting work-life balance.

- Physical Demands: Field inspections involve climbing ladders or assessing damage in harsh weather.

- Income Variability: Independents face feast-or-famine cycles.

- Bureaucracy: Navigating policy fine print and disputes can be frustrating.

Weigh these against your lifestyle preferences. Many find the rewards outweigh the drawbacks.

How to Become an Insurance Adjuster

Starting out is straightforward. Most states require a pre-licensing course (20–40 hours) and passing an exam.

No college degree is mandatory, but related experience in customer service or construction helps. Entry-level jobs provide training.

Build skills in negotiation and report writing. Networking via associations like the National Association of Independent Insurance Adjusters accelerates growth.

Career Advancement Opportunities

Progression is rewarding. From junior adjuster, move to senior roles overseeing teams.

Specialize in niches like cyber claims for higher pay. Management positions can reach $100,000+.

Continuing education keeps you competitive. In 2025, tech skills like using drones for inspections are increasingly valued.

Conclusion

In summary, the insurance adjuster salary offers solid potential, with medians around $76,000 and room to grow beyond $100,000. Factors like location, experience, and job type play key roles, making this a versatile career choice. Whether you’re drawn to stability or high-earning adventures, the field provides options. Research your state’s requirements and start licensing to unlock these opportunities.

FAQ

What is the starting salary for an insurance adjuster?

Entry-level salaries typically range from $50,000 to $65,000 annually. This includes base pay plus benefits, with potential for quick increases through experience and certifications.

Which states offer the highest insurance adjuster salaries?

Washington, Michigan, and Georgia top the list, with averages from $78,000 to $85,000. These areas have high demand due to population growth and industry needs.

Do I need a college degree to become an insurance adjuster?

No, a degree isn’t required. State licensing via exams is the main entry barrier, though a background in business or related fields can give you an edge.

(Word count: 1,512)